5 ways to increase your productivity using Excel

Microsoft Excel has been an accounting workhorse for decades, acting as the straightforward, flexible way to create your own accounting workpapers, cashflow projections and in-house calculators.

And, even when your spreadsheet tools are almost 40 years old, there are still ways to improve, refine and enhance your use of Excel as an accounting firm.

We've highlighted five important ways to increase your productivity when using Excel.

Why is Excel still the accountant’s most trusted software tool

They say that cockroaches would be able to survive a nuclear blast. In much the same way, Excel continues to survive in the accounting software world, despite all the nuclear explosions that cloud accounting, software automation and artificial intelligence (AI) have delivered.

There’s a very good reason for Excel’s longevity – it’s bloody good at what it does! It’s not a smart solution with millions of features, although recently Microsoft has introduced Copilot for Excel, allowing this smart AI helper to interpret financial data, automatically pull out interesting insights and carry out cashflow projections etc.

But at base level, Excel is:

- Simple – you don’t need a degree in mathematics to use an Excel spreadsheet. It’s easy to create a sheet, add in the numbers and then start messing around with formulas.

- Familiar – Excel has been around since 1985, so it’s a tool that every accountant will have used at some point. It’s an old, familiar mutt that makes the place feel like home.

- Flexible – Excel can be as straightforward or complicated as you want it to be. Whether you’re just summing totals, or using pivot sheets, Excel is flexible enough to do the job.

For all these reasons, this is why we (as accountants) love Excel. It’s the simple-to-use tool that’s probably got you and your practice team out of many accounting headaches over your years in practice.

But wouldn’t it be great if you could get a little more efficiency and productivity out of Excel, without losing any of the simplicity, familiarity and flexibility?

5 Major areas where you can supercharge your use of Excel

In some ways, it’s taken Excel a while to keep pace with the never-ending surge of software innovations in the accounting world. But we still love it, and many firms use Excel on a daily basis to run calculations, run forecasts and deliver their reporting, etc.

But here at AccountKit, we believe there are ways to breathe new life into Excel. If your firm loves the simplicity, familiarity and flexibility, but would love to do more with Excel, we’ve pinned down some key ways to make this happen.

Here are five core areas where AccountKit can lend a helping hand to Excel:

- Access – when you’re in the middle of a job, you need access to your Excel workpapers fast! With the upgrades to AccountKit’s our integration to your document management system (DMS), there's no need to wait for your documents to sync from desktop to the cloud. You can rename, edit, favourite and generate from a template your most important Excel workpapers anywhere in your DMS from within AK. So, you always have the numbers you need at your fingertips.

- Standardisation – we love Excel at AccountKit. It's the backbone of your workpapers and our own workpapers at our accounting practice. What we endeavour to do with all our compliance tools is bring standardisation across teams, business and practices alike. That means no matter where you look, all the workpapers you extract from our compliance tools will look the same, and will include the same calculations. This means less scope for errors, overwriting formulas or having team members do things their own way. That uniformity is a huge bonus, removing the worry of multiple different Excel templates and giving your practice team a standardised way of working with client data.

- Productivity – overly complex processes and button presses can start to eat into your practice time. At AccountKit, we believe in reducing the number of clicks you make each day. That’s why we let the software do the heavy lifting of running calculations. Whether it's div7a, equipment finance or reconciling inter-entity loans, our tools help you be more productive and can export to Excel to include with your work papers.

- Accountability – monitoring your income tax lodgement status has always been something accountants view in Excel. With AccountKit, rather than keeping this data in Excel and running pivot reports each month, you can leverage off the ATO portal lodgement report. This allow for a whole new way to report on your income tax lodgements. Via our ATO statistics dashboard, you can monitor your current lodgement status. You can even dynamically filter and compare your ATO lodgement list to your client list, ensuring that everyone who should be is accounted for.

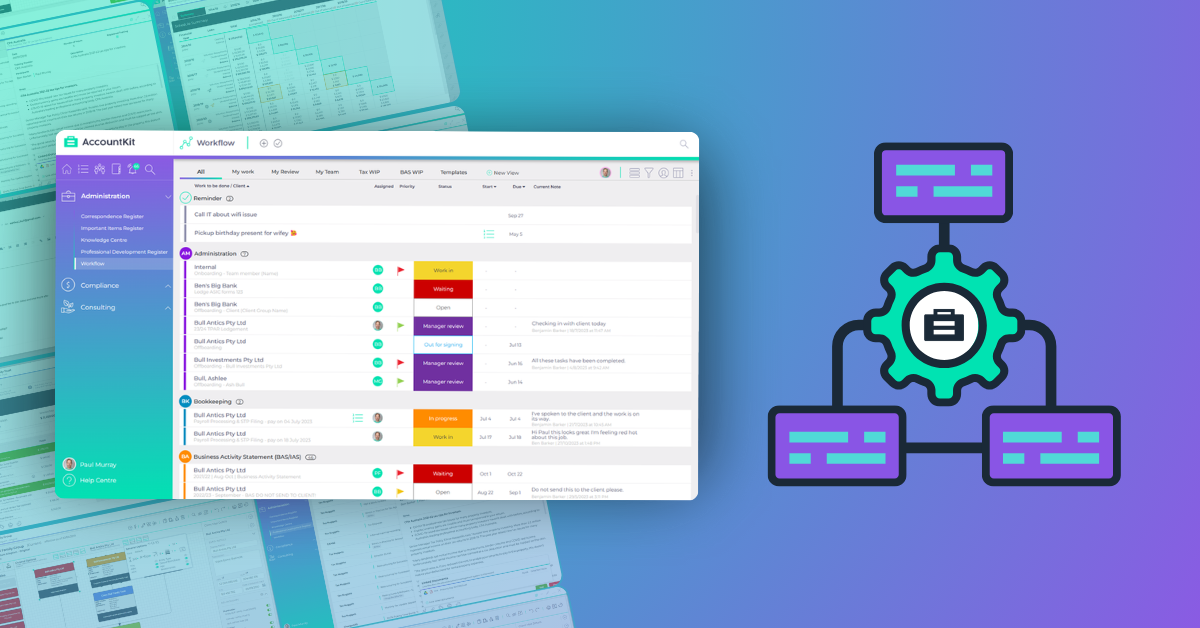

- Visibility – keeping tabs on all those Excel workpapers can be a big task. With AccountKit’s workflow, you have complete oversight and insight into the progress of the work in your practice. Where you have an integrated DMS, you can link key workpapers, AccountKit tools and source documents back to the checklist items in your task. There’s no more searching and your reviewers have instant access to the correct Excel workpapers, improving your workflow visibility at a stroke.

AccountKit and Excel: The Accounting Dream team

With Excel workpapers still such a fundamental element in your firm’s accounting process, it’s good to know that there are ways to keep this familiar tool in the equation, but without losing any of the benefits of working with modern-day, cloud-based accounting tech.

AccountKit and Excel are the dynamic duo of accounting, pairing up to provide your firm with the most expansive and flexible ways of getting your client engagements under control.

In addition to the five areas above, AccountKit has a growing range of tools that incorporate, refine and support your use of Excel:

- Inter-entity loan – typically, you’d need to export a list of transactions to Excel from two Xero files, which are then manually matched and reconciled. But with AccountKit, you can show the transactions, auto-match them and then post the balancing entries in bulk. A process that can take hours when done manually in Excel now takes minutes instead.

- Cashflow forecasting – Cashflow statements are still habitually exported into Excel. But with AccountKit, you can export the client’s equipment finance cashflow commitments and create up-to-date, on-demand cashflow overviews that keep the client’s finances under control.

- Div7a – Div7a forecasting in AccountKit can provide reliable future projections, a massively important tool when advising your client and something that would usually require a manual calculation in Excel, in most instances.

- ATO lodgements – instead of spending hours carrying out the time-consuming process of sorting your ATO lodgement data, utilising pivot tables, AccountKit helps you get the job done in seconds. There’s also more functionality, with cross-checking of client data against ATO records, and historical graphs for comparing performance over the years.

Wherever you use Excel in your firm, there’s a way for AccountKit to expand your productivity. By complementing Excel (rather than trying to make it redundant), we can support your existing processes.

With our range of tools, we give your firm a competitive digital edge that makes you more agile, more flexible and ready for the next evolution in accounting.

Read to bring your compliance into the 21st century and level up your Excel?

Share this

You May Also Like

These Related Stories

AccountKit and Excel: your accountech dynamic duo

Make Accounting Smarter with Automation Tools